Development Projects: How to buy them?

Investing in a development property (new build) in the Czech Republic can be an attractive opportunity, whether you’re looking for a home or a long-term investment. However, buying a property that is still under construction comes with its own set of advantages, challenges, and financial strategies that you should carefully consider.

In this blog I would like to inform you about the overall picture of how I look at development projects, what are the specifics in contrast to buying an already built apartment and how to approach the whole thing.

Advantages of Buying a Development Property

Lower Initial Price – Buying early in the project often means securing a lower price compared to the market value upon completion. Now of course you need to consider that you cannot compare prices of older (10+ years) to a new development projects.

Customization Options – Developers generally allow buyers to choose interior finishes, layouts, and materials, which can be very nice as you can customize your home however you need. Keep in mind this is only possible in the early days of construction and cannot be done if the constructions is already largely finished.

New Technologies & Energy Efficiency – Newly built properties meet modern energy efficiency standards, leading to lower utility costs. All new apartments NEED to have a PENB (energy efficiency rating) of A or B, which in contrast to fluctuating energy prices is an advantage.

Value Appreciation – The property’s value often increases between the time of signing the contract and the project’s completion, allowing for potential capital gains and generally newer properties tend to evaluate a little better than an old apartments in old buildings, but I guess that makes sense.

Disadvantages and Risks

Long Waiting Period – Depending on the stage of construction, you may have to wait months or even years before you can move in or rent it out. So if you need to move in immediately, development project is not a good option for you.

Developer Risks – If a developer faces financial difficulties, the project could be delayed or, in extreme cases, halted leading to some potential financial risk. Always check who is the developer, if there were already some finished projects, check Google and search for the developer if you do not think some news that might be concerning etc.

Cash Flow Challenges – Payment structures during construction can be financially demanding, especially if you are also paying rent elsewhere. More later in this Blog!

Market Fluctuations – While property values tend to rise, there’s always a risk of a market downturn before completion.

How Are Development Projects Paid For?

Most developers in the Czech Republic follow one of these payment structures:

Standard Deposit Model – You pay an initial deposit (typically 10–20% of the property price) when signing the contract, with the remaining balance paid upon completion. This is not very typical nowadays especially for Prague and Brno market, as developers tend to request payments as the construction go – progressive payments model.

Progressive Payments Model – Payments are made in stages during construction (e.g., 20% at signing, 30% when the foundation is completed, etc.). This requires ongoing mortgage drawdowns, which means you start repaying the mortgage even before moving in. If you’re renting another property at the same time, this can strain your cash flow.

I want to give you real exact numbers so you know exactly what to count with

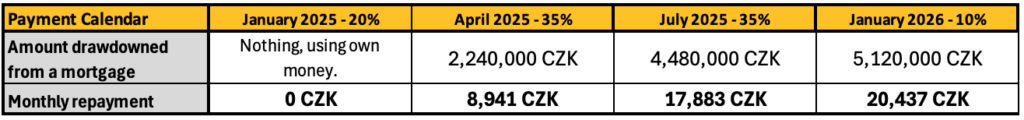

- EXAMPLE OF PROGRESSIVE PAYMENT MODEL – let’s say you are buying a development project for 8 milion Crowns and you are taking 80% mortgage (rate 4.79%). You signed the contract in January 2025 and the apartment will finish in January 2026. During this time developer wants part of the payments as follows: January 2025 20% (own resources), April 2025 35%, July 2025 35%, at the end of construction January 2025 remaining 10%. How would this look like in terms of mortgage payments? See here:

As you can see the payments are not as high as the regular mortgage repayment because you are only paying interest for the amount you already drawdowned from a bank. Hopefully this sheet made it more understandable 🙂

Managing Cash Flow During Construction

One of the biggest challenges with progressive payment models is handling mortgage payments while still paying rent. If you finance the purchase with a mortgage keep a sufficient reserve and calculate exactly what repayments you will have to make during the construction – or write to us and we will figure it out for you.

Leveraging Time for Value Appreciation

A key advantage of development projects is the time gap between signing the contract and the property’s completion. If you buy early in the project, the market value may rise significantly by the time you take ownership. This means:

You may secure a mortgage based on a lower purchase price while the real value of the property increases.

If you decide to sell before completion, you might be able to assign the contract to another buyer at a profit (subject to developer approval, but usually possible).

When to Secure Your Mortgage?

One of the critical decisions when buying a new build is when to secure mortgage approval. You generally have two options:

Secure Mortgage Approval at the Beginning (Recommended)

Guarantees that you will have financing in place when payments are due.

Protects against rising interest rates.

Ensures you meet the developer’s financing deadlines without last-minute stress.

Wait and Approve the Mortgage Closer to Completion (Risky Option)

If interest rates decrease, you might secure a better deal.

However, if rates rise, you could end up paying significantly more or even struggle to qualify for the mortgage and that is the biggest risk.

Given the uncertainty of interest rate movements, securing a mortgage at the beginning is generally the safer approach, especially if you want financial certainty.

Final Thoughts

Buying a development property in the Czech Republic can be a profitable and strategic investment. However, it requires careful planning regarding financing, payment structures, and cash flow management. Ensuring you have a solid mortgage strategy in place will help mitigate risks and make the purchasing process smoother. If you’re considering such an investment, working with an experienced financial advisor can provide valuable insights tailored to your situation.

This article has been written by Maxmilián Rožek.

Maxmilián Rožek

Mortgage Advisor, Co-founder of CzechAdvisors

We have our own dedicated Podcast for Expats!

Good Mortgage Czechia! is a podcast about the financial system of the Czech Republic specially tailored for expats living in the Czech Republic.

Specifically, we will talk about how to arrange a mortgage in the Czech Republic, what to look out for when buying a property, or how to invest your money properly so that it does not lose value in the long term.

You will be guided through the podcast by Maxmilián Rožek and Štěpán Kubeček, founders of CzechAdvisors, a financial consulting company for expats living in the Czech Republic.

Our website: https://www.czechadvisors.cz/

Starting from September 2024 there will be considerably higher fees for early repayments or refinancing of a mortgages.

How will this change affect the mortgage market in Czech republic?

If there would be some unaswered questions or you would like to talk with us, leave us a message and we’ll get back to you!

Related Posts

Development Projects – How to buy them?

Development Projects: How to buy them? Investing in a development property (new build) in the…

You Do Not Need Permanent Residence (PR) In The Czech Republic To Buy a Property in Prague

You Do Not Need Permanent Residence (PR) In The Czech Republic To Buy a Property…

Early repayment of mortgages will be more complicated starting from September

Early repayment of mortgages will be more complicated starting from September Banks will be able…

How Long Does It Take To Process a Mortgage as an Expat?

How Long Does It Take To Process a Mortgage as an Expat? PREFER PICTURES OVER…